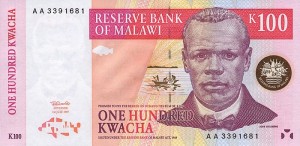

Merits and demerits of depreciated Malawi kwacha

Published on July 15, 2011 at 2:03 PM by FACE OF MALAWI

By Paul Mphwiyo

LILONGWE – It is now roughly over one year since our country started encountering economic turbulence: The external position is precarious and our country’s exchange rate policy has once again attracted the attention of those in Washington who are calling for a serious realignment of the kwacha to correct the external imbalance.

LILONGWE – It is now roughly over one year since our country started encountering economic turbulence: The external position is precarious and our country’s exchange rate policy has once again attracted the attention of those in Washington who are calling for a serious realignment of the kwacha to correct the external imbalance.

The figures that one hears range from 10 to 30 percent, but skewing towards the higher end. To borrow the words of Alan Taylor, the irony is that while we have been celebrating our economic successes together, the current problems have been orphans to many people right up to their inception, after which they have become the scions of self-styled commentators who are saying really nothing other than reminding us of the problems.

While I agree that this has been a tumultuous period, I am deeply concerned that if we focus on the short-run perspective, we risk losing sight of the long term picture. As an economist and a policy-maker who has experience in dealing with the country’s economic programmes, I want to offer arguments on both ends.

This should be a good precursor to the next episode in which I will offer my preliminary insights on how we may decouple from this debacle and why the zero-deficit budget may be a necessary though painful fiscal adjustment because a monetary adjustment—through a more depreciated exchange rate—was deemed undesirable.

Exchange rate systems are categorised into three broad categories of flexible (free and managed float); intermediate (peg or basket peg, horizontal band, crawling peg, crawling band) and fixed (currency board, monetary union and dollarisation).

<p>The International Monetary Fund (IMF) categorises our regime as a managed float but my view is that we have a de facto peg to the US dollar. Among economists, there is consensus that the choice of the exchange rate system to reach monetary policy goals largely depends on the transmission mechanism of monetary policy impulses.

The argument for currency depreciation is well founded in theory. Firstly, the J-Curve effect suggests that depreciating a currency initially worsens the trade balance and then improves it, thus correcting any prevailing external balance over the medium term. This, however, does not hold for commodity producing countries like Malawi.

Secondly, the axiomatic “Impossible Trinity” spells conflict between three potentially desirable policies of: (a) A fixed exchange rate (b) Internationally mobile capital and (c) Monetary policy independence.

For instance, a credible exchange rate peg (item a) means that you will not devalue and in that case interest arbitrage (item b) locks your rate to the base country’s rate, meaning a loss of monetary autonomy (sacrificing item c).

To break the tight link between the domestic and foreign interest rate (item c) the authorities need to either stop arbitrage through capital controls (sacrificing item b), or else allow the exchange rate to move by going from a peg to a float (sacrificing item a).

From a theoretical perspective, it is clear how these trade-offs should operate, but from a practical viewpoint, developing countries like ours are even more constrained than this trilemma posits. Fiscal dominance further constrains credible monetary policy.

Our colleagues in Washington have a snap shot of our economy—a financial programme comprising the real, external, fiscal and monetary sectors. This interdependent system should be showing a clear external imbalance: Driven by an upsurge in both government and private import demand, the current account is negative and worsening.

Although it sounds unrealistic when authorities are talking, figures show sustained spikes in car imports. It is not difficult to appreciate why the country’s fuel requirements have doubled from about $15 million/month 10 years ago to about $30 million per month recently.

In addition, there are infrastructure projects going on in the country, not to mention all the residential properties that are being developed—with China as an attractive source of fixtures and fittings. Johannesburg bound aircraft and buses are perennially full of Malawian shoppers and businessmen. The list is endless.

Monetary accounts consistently show spikes in credit to the private sector but it is all too clear that this credit is not for production but consumption. And on account of past fuel and commodity price shocks, including fertilizers, the fiscus too posted some deficits higher than planned. Simply put, the high growth rates have caused a surge in import demand and the negative terms of trade and price shocks that we suffered amplified this effect, thus overheating the economy.

IMF’s argument is plausible firstly because a shortage of forex limits the country’s growth prospects by affecting the importation of raw materials for production. Secondly, maintaining a credible peg needs substantial reserves.

With low international reserves manifested in forex rationing, forex queues/backlogs and a wide spread between the official and parallel rate, the credibility of an exchange rate peg greatly plummets, further subjecting the domestic currency to a speculative attack.

With low reserves, a speculative attack is difficult to suppress and constraints of the trilemma would entail very limited monetary policy options, the most obvious being currency depreciation. The conjecture here is that a more depreciated kwacha would correct the external imbalance through its effect on tradables and close the large spread between the official and parallel rate.

From a fiscal viewpoint, that would also entail more kwachas from donor inflows, negating the need for a tighter fiscal adjustment. If anyone had provided such an answer in a macroeconomics theory exam, they would get a straight A+.

But government’s stance is also compelling. First, the argument of dampening import demand is a mere sugar-coating of the fact that a more depreciated kwacha would make our imports more expensive and breed inflation because of high pass-through.

This is extremely important to a landlocked country like Malawi with high susceptibility to exogenous shocks. It is also not difficult to see that trying to catch up with the parallel rate is like chasing a shadow which will make the exchange rate over-shoot. And with higher inflation, fiscal gains from donor inflows are bound to have a benign real effect. It is almost a zero-sum game.

These are just the obvious problems; there are many others no less severe. Guillermo Calvo, my macro professor at Columbia University and celebrated author of ‘Fear of Floating’would be upset if I did not mention that most developing countries—including Malawi—suffer from “Original Sin” in that they are unable to borrow in their own currency on the international market.

This has substantial balance sheet effects in that large devaluations in the presence of a currency mismatch like we have—where our external assets are less than external liabilities—will have proportionately large valuation effects on our external balance sheet with deleterious effects on output.

From a global perspective of the international monetary system, my beloved International Macroeconomics Professor, Robert Mundell, Nobel Laureate and Father of Optimal Currency Areas, would clearly prefer a fixed over fluctuating system because the latter is an “exorbitant privilege” that practically transfers seignorage gains to the United States without managing the interdependence of currencies or stabilising prices.

That is why all major crises happened during the system of fluctuating rates and they are all associated with large swings in major exchange rates. In their best-selling book on the recent financial crisis, ‘This Time is different’, Carmen Reinhart and Kenneth Rogoff corroborate this assertion.

On the balance of the arguments, it is my view that the local jury returned with a more compelling verdict. The external jury missed crucial evidence in their consideration and they could give us a mistrial.

We can ask the East Asian Tigers and most emerging economies in Latin America where planned devaluations massively overshot, sending them into economic abyss for some time. And not long ago, a sub-prime mortgage crisis in the US tipped the world into a recession, which has barely abated. The same macroeconomic surveillance experts could not smell anything once again and still remain surprised.

Going forward, the road will be rough and there are no easy answers. In the short term, donor resources are a matter of necessity because they form a substantial part of our reserves; there must be fiscal restraint augmented by austerity measures; and monetary policy should remain tight, among others.

Over the medium to long term, we need to start asking ourselves what we have done “to transform Malawi from a predominantly importing and consuming nation to a producing and exporting nation.”

In the words of John F. Kennedy, we need to start asking ourselves what we have done for our country and not what our country has done for us. Key questions include: What will be the strategic sectors to drive growth? What role can government play? How do we address structural constraints to growth—transport, energy etc? Do we need civil service reform to prepare it for the challenges? We will share our thoughts in the coming series.

Note: The article was first published in The Nation newspaper

Paul Mphwiyo holds a BA and MA in economics from Chancellor College, an MBA and MA in economic policy and management from Columbia University. He is currently consulting at one of the top international institutions in Washington DC before continuing with further studies in economics. Just before taking his study leave, he was acting director of economic affairs at Malawi’s Ministry of Finance