The Malawi Revenue Authority (MRA) has said over K22 billion is tied in court cases and has since proposed the Judiciary to set up special courts to deal with the matters.

Speaking during an MRA-Judges conference on Monday in Mangochi, the tax authority’s Commissioner General Raphael Kamoto said they are committed to work with the court to ensure speedy delivery of justice on tax cases.

“We would like the K22 billion or part of it going towards hospitals, schools or other amenities rather than being held by a few tax payers. At MRA we strongly believe in the judicial system, and that is why we always resort to the courts for legal advice. On our part, we offer an efficient tax payers service which seeks to improve tax compliance by making it easier to remit taxes and responding to enquiries expeditiously,” said Kamoto.

He encouraged tax payers to first appeal to the commissioner general in matters related to tax before resorting to the courts.

But speaking in a telephone interview on Tuesday, Malawi Confederation of Chambers of Commerce and Industry (MCCCI) president Newton Kambala encouraged MRA to treat tax payers as partners and not as adversaries while Economic Empowerment Action Group (EEAG) president Lewis Chiwalo said sometimes the tax authority raises tax invoices without any basis.

“Sometimes there are problems in the way import and excise duties are calculated and this makes some importers to resort to the courts for litigation. This does not only affect tax revenue but also slows business. MRA should not only aim at collecting taxes but also facilitating trade,” said Chiwalo, arguing that the country’s tax rates are prohibitive and that lower rates would encourage compliance.

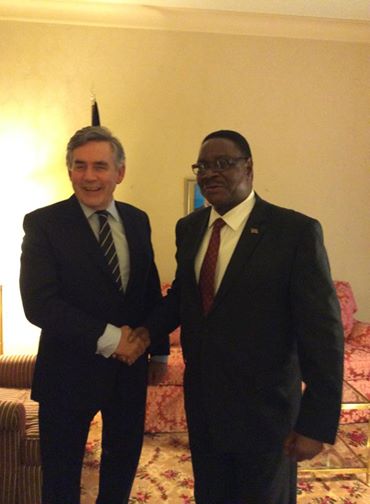

FaceofMalawi speaking to guest of honour at the function, Chief Justice Anastanzia Msosa said the conference was important because it would look at how to perform better.

“At the end of the conference we will have a better understanding and ensure that issues that involve tax revenue should not delay,” said Msosa.

She pointed out that it was important that MRA meets its targets under this year’s zero aid budget noting that the Judiciary should ensure that they are not an obstacle in revenue collection.

This year, the government has projected tax revenues to increase to K470.1 billion compared to K388.4 billion collected last year. Total revenues and grants are estimated at K635.6 billion with domestic revenues projected at K525.3 billion.

.jpeg&w=60&q=100&h=60)